5 Best Finance and Budgeting Apps on Android

As information becomes easier to access, more people are becoming financially literate. Many are now starting to budget and track their spending so they can manage money better and work toward future financial goals.

These days, financial management doesn’t have to be done with notebooks or spreadsheets. Digital tools make it much easier. If you’re an Android user, here are some great apps that can help you track, budget, and stay in control of your finances.

1. Wallet

Maybe you’ve been informed enough about this app since Wallet has quite a large user base worldwide. As a financial app, Wallet is versatile because it can be used for personal financial records or small-scale businesses.

With so many users across the globe, Wallet also supports multiple currencies, so users outside the US can record balances directly in their local currency. This is practical because you don’t have to bother converting balances to US dollars.

One of my favorite things is that Wallet immediately displays various information in the form of graphs and lists of your financial activities on the main page. This way, users can analyze their financial behavior without any confusion.

Wallet can also be used for budgeting and setting financial goals. The app can sync with various banks, so transactions will be automatically recorded. Because of this feature, you don’t have to enter transaction details manually.

Those who want to record their shopping lists can also rely on Wallet because of its Shopping List feature. You don’t even have to type each item and price manually, as it also supports voice input that converts speech into text.

What I like about Wallet:

- A multifunctional app that can track your finances and more

- Provides many features for financial activities and recording

- Syncs with various banks

- Supports multiple currencies

- Includes a currency exchange feature

- Has a large user base

One thing to note:

- Some features are still restricted in the free version

2. Monefy

Monefy is one of the best financial apps I’ve ever tried in terms of design. On the main page, you’ll find a large pie chart filled with intuitive icons representing different expense categories, like a phone for communication, cutlery for dining, or a house for rent. Adding transactions is also simple, just enter the amount and a short note.

Monefy also lets you record finances daily, weekly, monthly, yearly, or even over custom intervals. You just need to choose whether you want to record today’s finances or add entries for previous days you missed.

Don’t forget to record your income as well, so the system can calculate your balance automatically! Monefy also supports multiple currencies, although converting to currencies other than USD requires a Pro subscription.

While the app’s overall look is attractive, the features are fairly standard. It doesn’t even have reminders for financial activities such as bill payments. So if you use Monefy, you’ll still need to schedule payments on your own.

What I like about Monefy:

- Attractive and simple interface

- Easy to use, even without tutorials

- Flexible recording by custom time periods

- Supports multiple currencies

Things to note:

- Limited features compared to competitors

- Currency options beyond USD require a Pro subscription

3. Spendee

Apart from recording your financial activities, Spendee can also be used as a budgeting app. It displays your transactions and immediately presents them in diagrams with interesting insights into your spending habits.

Spendee can also track different types of assets, not only cash but also e-wallets and crypto wallets. This feature, called Wallet, helps you monitor spending across your total assets and wealth.

Unfortunately, while it provides asset tracking, it does not include an app lock feature. This makes it risky to record all your assets without using an additional locking app.

Spendee’s transaction logging is also unique. Not only can you record the transaction amount and time, but you can also add a photo as proof, which is something rarely found in other finance apps.

The app also comes with ready-made categories for both expenses and income. You can customize them by deleting unnecessary categories or creating new ones.

What I like about Spendee:

- In addition to recording financial activities, you can also track assets and wealth

- Can be used as a budgeting app

- The transaction recording menu is quite comprehensive, with a feature to add photos as proof

- Can be connected to various banks

- Provides ready-to-use transaction categories

Things to note:

- Some features require a premium subscription

- Lacks a password lock feature, which makes asset tracking less secure

4. Realbyte Money Manager

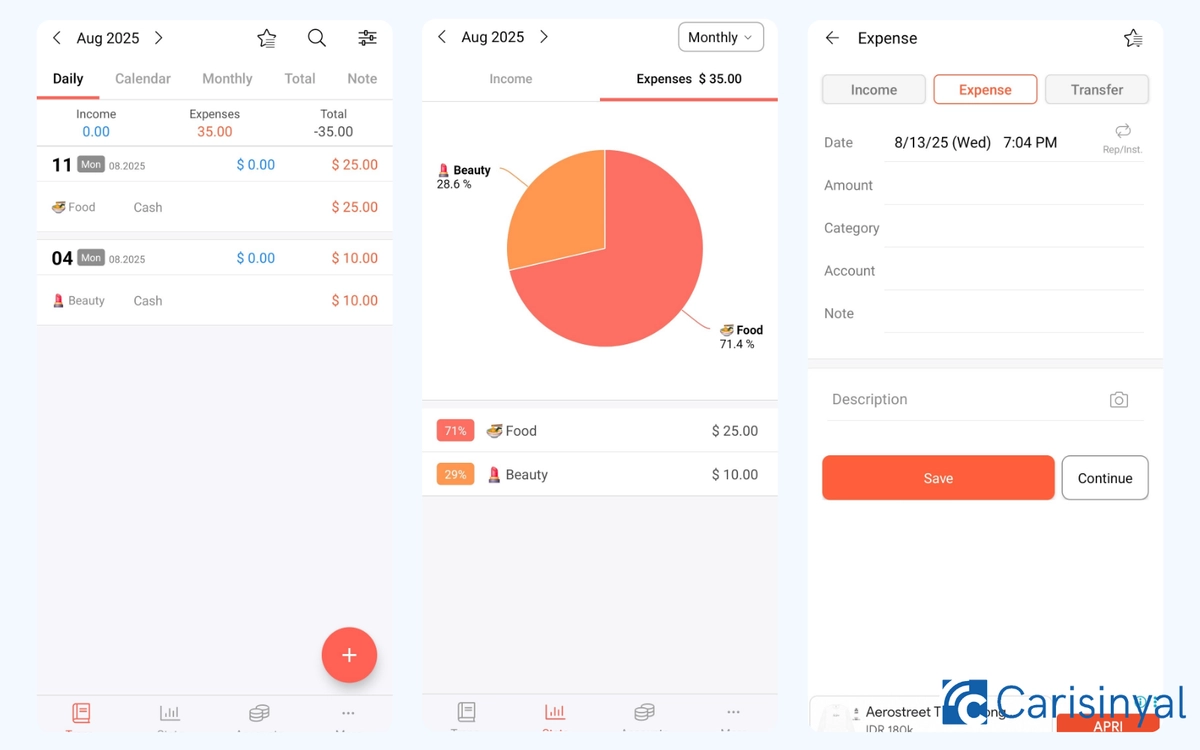

This app records three main categories of transactions; expenses, income, and transfers. Transfers refer to transactions made through your bank account. You can connect one or more accounts for automatic transaction recording.

Transactions can be viewed daily, monthly, or as totals, and there’s also a calendar feature that summarizes all balances.

Realbyte also includes a built-in calculator on the input keyboard that makes it easier to calculate multiple transactions in one category. For example, if you shop at several stores in one day, you can quickly total all expenses without leaving the app. Very practical!

The only downside is the banner ads that appear at the bottom of the app. These ads often clash with the app’s menu layout, which is also positioned at the bottom.

Things I like about Realbyte Money Manager:

- Can be linked to multiple bank accounts

- Calendar view that records all transaction balances by date

- Useful calculator feature for adding up expenses

- Provides a tutorial for each feature during installation

One thing to note:

- Banner ads sometimes interfere with the bottom menu layout

5. Goodbudget

Although it comes with a standard template, Goodbudget still has enough features to help track your finances. The app records all your expenses and transactions, then automatically calculates them against your income.

However, you need to input every detail of each transaction, including the amount, date, and payment method. For bills that need to be paid regularly, Goodbudget allows you to schedule them.

Like most budgeting apps, it presents financial reports in the form of pie charts and bar charts so you can easily monitor your spending habits.

Despite its simple design, Goodbudget allows you to share financial reports with others, such as your spouse. To use this feature, though, you must register with an email account, as guest mode limits access to some functions.

Things I like about Goodbudget:

- Simple yet feature-rich money-tracking app

- Can record income and expenses in detail

- Provides financial reports in pie and bar chart formats

- Most features are available for free

Things to note:

- Standard design that’s not visually appealing

- No tutorial on how to use the app

- Some menus are less intuitive and have cumbersome navigation

With these financial tracking apps, you no longer need to create manual tables or analyze transactions on your own. Your data is automatically processed into easy-to-read reports, helping you assess your financial habits, make improvements, and achieve your goals as planned. Good luck!